Discover How We Can Help

If you’d like to know more about how we help buy, sell or relocate do not hesitate to contact us today!

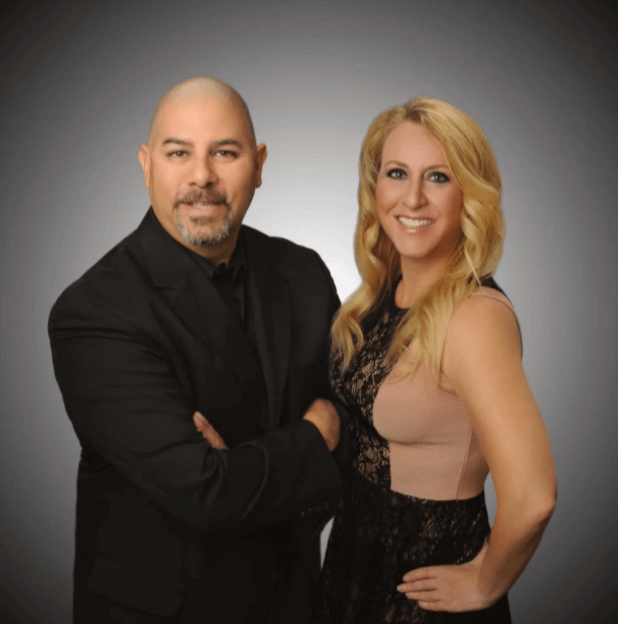

Meet The gonzales team

At Foxhole Properties, real estate is more than a business — it's a mission rooted in integrity, honor, and selfless service. As a combat Veteran family-owned team based in Las Vegas, Ernie and Leah Gonzales bring decades of experience, community commitment, and a deep appreciation for those who serve. Since 1999, they’ve helped over 2,500 families and businesses buy and sell homes and commercial properties across the Las Vegas Valley, delivering results with expert guidance and genuine care.

With strong ties to the military and local organizations, Ernie and Leah blend their professional excellence with a personal passion for service. Leah, a UNLV graduate and lifelong Las Vegas resident, champions veterans and local nonprofits. Ernie, a Desert Storm Army Veteran, brings military discipline and leadership to every client interaction. Whether you're buying, selling, or investing, The Gonzales Team is here to serve with heart, dedication, and the experience you deserve.

Latest homes on the market

Check out the latest homes that have have hit the market!

Explore the greater las vegas area

From vibrant city living to quiet desert retreats, the Las Vegas area offers something for every lifestyle. Whether you're relocating, investing, or finding your forever home, Team Foxhole brings local expertise and mission-driven service to every step of the journey. Let us help you navigate the neighborhoods and find the perfect fit.

LET'S GET STARTED

Every successful mission begins with a solid plan — and we’re here to help you make yours. Whether you're buying your first home, selling a property, or relocating to Las Vegas, Team Foxhole provides the guidance and grit to get it done right. Our team combines real estate expertise with a commitment to service that runs deep. Reach out today and let’s take the first step together.